BoG scales up surveillance over reports that banks are closing foreign currency accounts despite banks refuting rumor

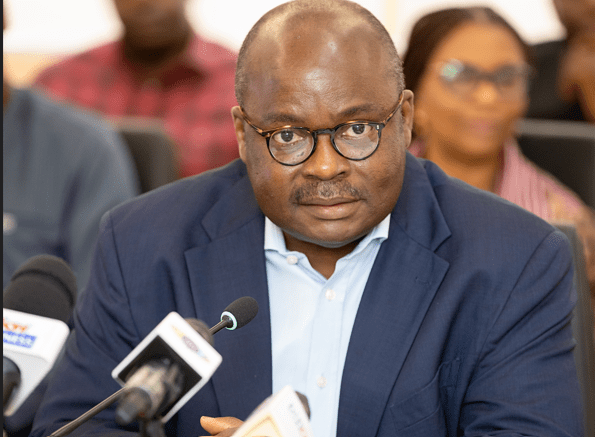

Governor of the Bank of Ghana (BoG), Dr Ernest Addison, has served notice that the central bank is keeping a close eye on banks over rumors that they are planning to close personal foreign currency savings accounts by the end of July this year.

Governor Addison said although the banks have refuted this rumor, it is necessary for the regulator to monitor them closely on that.

Asked whether this rumor may have come out as a result of the BoG’s earlier directive to the banks to increase lending to the private sector than to the government, while speaking at the 119th Monetary Policy Committee press conference in Accra on Friday, July 26, Dr Addison said “The intention for that particular measure [lending to private sector] was to withdraw as much liquidity as possible from the economy and the data that we have suggest that we have been able to do that. We also know that credit to the private sector is beginning to pick up. Remember, this economy is emerging from a crisis, non-performing loans are higher, and the risks associated with lending are higher so the banks are being cautious in terms of how much they lend to the private sector.

“Since the implementation of that policy, we are seeing credit to the private sector increase albeit by major remarks. But I think the more important development is amount of the Cedi liquidity the central bank has been able to withdraw from the economy, this was the objective behind that policy measure.

“You asked whether banks closing down foreign exchange accounts is an unintended consequence of this measure. The banks will tell you that it is not an unintended consequence of that.

“If the banks feel they don’t want to provide Cedi cover for foreign currency deposits because the more foreign currency deposits that they accumulate the more Cedis reserves that they have to place with the central bank, so they have the incentive to do that but we have engaged them and they have come back to us that they don’t have an objective in mind. We are going to be watching that area very closely. As I said it is the only bank that issued letters to clients, none of the 22 other banks did that. Besides they have officially come out to clear the air on that issue.”

Assurance from the Ghana Association of Banks

The Chief Executive of GAB, John Awuah, Ghana Association of Banks (GAB) while refuting the rumors clarified that the decision was made by only one bank, not all commercial banks.

“No bank has taken any decision to discontinue deposits in foreign currencies. Rather, one bank has reviewed its products offerings and decided that they are not going to henceforth be operating using accounts in foreign currencies,” he told journalists earlier.

He reassured that the decision by that particular bank was aimed at stabilizing the local currency and preventing speculation.

“(The bank) observed a trend where customers hoard foreign currencies in their foreign currency savings accounts. A practice which is feeding into speculation and leading to the depreciation of the Cedi and we do not want to be part of this,” he explained.