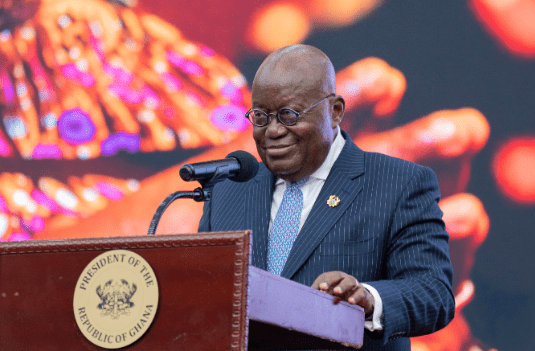

Banking sector clean-up: Gov’t releases GHC1.5bn to support victims

President Nana Addo Dankwa Akufo-Addo has directed the Finance Ministry to release an amount of GHC1.5 billion to cushion victims of the banking sector clean-up exercise.

The sector minister, Dr Mohammed Amin Adam, announced this during a UK Town Hall meeting over the weekend.

According to him, the government of President Akufo-Addo puts the welfare of Ghanaians first, indicating that people are accountable for their investment decisions and not the government.

“Ideally, government should not be held responsible for the investment decisions of individuals, but this government is so caring.

“Mistakes were made and people were not well-informed, and they didn’t know who to consult to be advised, but we also know that the people who are affected are suffering, and we have heard that some people have died and others had to commit suicide.”

“This government is so caring that in the first place, we granted some bailout to all the affected and I want to tell you again that the President has directed that we do another bailout.

“So between now and October, we will release 1.5 billion Ghana Cedis to the affected people,” said the Finance Minister.

Additionally, Dr Amin Adam revealed that the government has concluded the crucial debt restructuring programme with its official creditors.

The Karaga lawmaker emphasised that the government has successfully restructured its $5.1 billion debt with these creditors and completed the restructuring of $13.1 billion with Eurobond holders.

When did the banking sector reform take place?

The banking sector clean-up in Ghana refers to a series of initiatives by the Bank of Ghana (BoG) to stem an impending banking crisis between 2017 and 2020.

The sector cleanup led to the collapse of 9 indigenous banks and over 300 other finance firms. Some of the collapsed banks were consolidated and/or absorbed by other stronger banks.

In 2017, Capital Bank and UT Bank were the initial casualties and sold to GCB Bank in a Purchase and Assumption transaction.

Other financial institutions like Biege Bank, The Royal Bank, Unibank, Sovereign Bank, Construction Bank Ltd, Premium Banak, and Heritage Bank were merged to form Consolidated Bank Ghana (CBG).

Read also:

Financial sector clean up not Ofori-Atta’s idea, it was an IMF conditionality – Analyst

Another element of the banking sector cleanup was the increase in the minimum capital requirement. The BoG increased minimum cap from GHC102 million to GHC400 million.

The result was that some of the banks could not meet the new requirement, and as the deadline loomed, half a dozen of the banks merged to form new ventures.